How the Russo-Ukrainian Conflict Impacts Microchip Production

28. September 2022

Given the economic downturn, the threat of gas shortages, and an almost ten-percent inflation rate across Europe, the war in Ukraine is indeed impacting companies all over the world. Furthermore, the conflict is disrupting supply chains and exacerbating the global microchip crisis. Much of this is down to the limited availability of one key element, the noble gas — neon.

2022 was supposed to be different. The economy appeared to be in recovery after the pandemic – as did the semiconductor industry. But then, on February 24, Russia invaded Ukraine and transformed the market situation once again. The forecasted growth for 2022 is not expected to be reached.

Some companies realized how dependent they are on imports from Ukraine and Russia. Suddenly, the supply of gas, oil, and agricultural products became scarce. On top of that, the supply of neon, an essential substance for producing semiconductors was at risk too.

Neon and Its Importance for the Semiconductor Industry

Neon is a noble gas, meaning it is generally unreactive and can be found – in very low concentrations – in the Earth’s atmosphere. It is extracted in advanced air separation plants (also known as air separation units) as a waste product of oxygen production. Air is broken down into its components in a method known as the Linde process, resulting in a neon-helium mix. Large amounts of energy are required to separate the two elements, which is why the process is only worth carrying out if high quantities of neon are required.

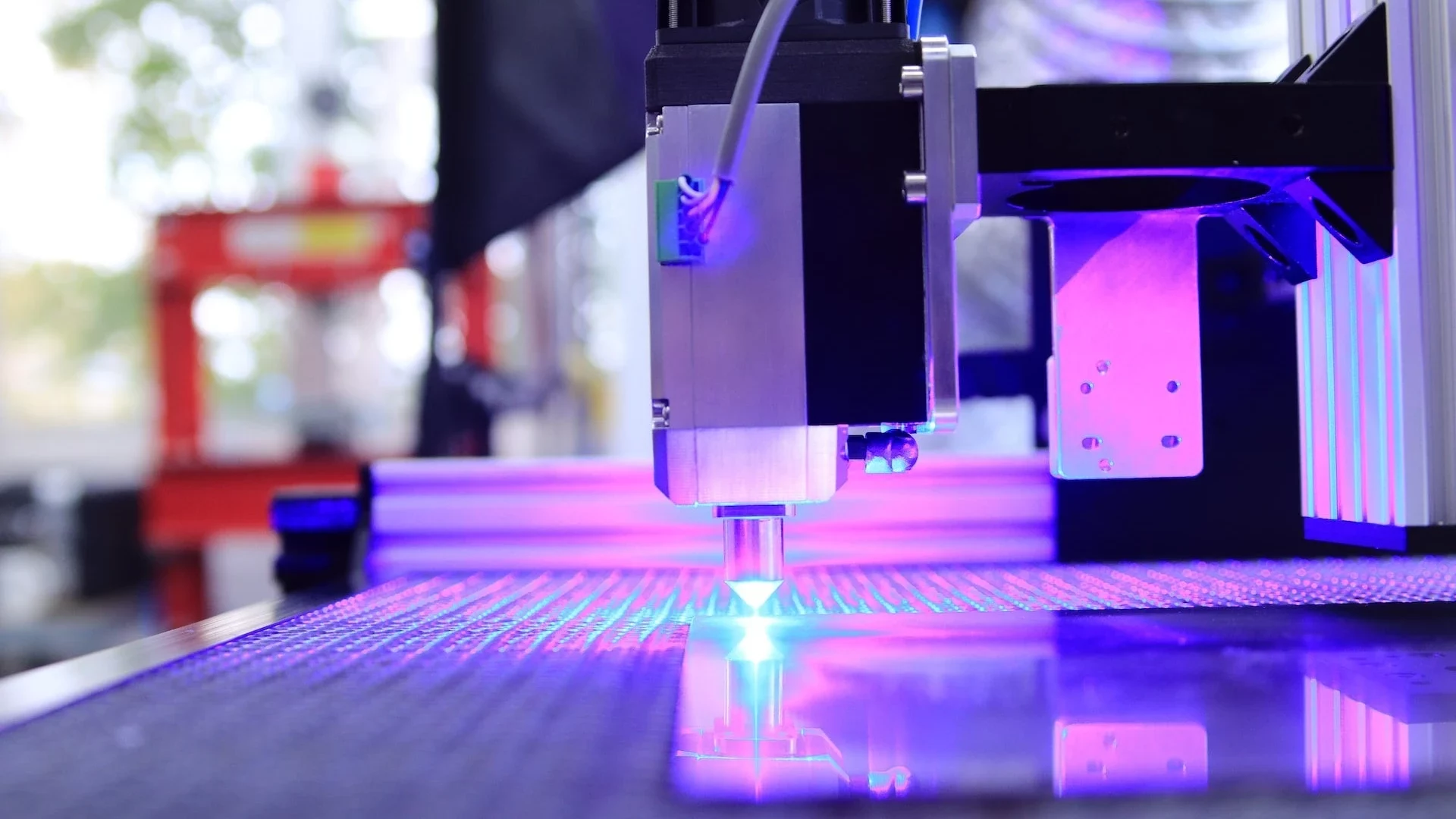

Neon is used in a process called photolithography, which is a vital phase in manufacturing semiconductors. Here, a designated laser etches microstructures onto a silicon wafer. As the neon becomes contaminated during this process, it must be entirely or partially replaced at short intervals.

Ukraine’s Production and Logistics Bottlenecks

Ukraine is currently the world’s leading producer of neon, and two companies are responsible for around half of the global supply. These are Ingas from the port city of Mariupol and Croyin, which is based in Odessa. Both cities have come under repeat attack from the Russian Army, forcing them to temporarily cease operations.

In addition, Ukraine was intermittently cut off from international maritime trade and transport routes were blocked, preventing the export of numerous goods.

Nonetheless, the year 2014 showed that crises could also drive innovation. When pro-Russian separatists occupied the Donbas and Russia occupied Crimea, the industry faced a challenge similar to the one it is currently facing. Prices for neon skyrocketed. Producers then successfully improved the efficiency of the laser process in which the gas is used.

As a result, it is now possible to clean and reuse some of the neon used in photolithography. Additionally, manufacturers can benefit from an advantage that will allow them to continue producing without restriction for the time being as they have a stockpile.

Where Do We Go From Here?

Although the current situation may have eased considerably, there is still no sign of normalization of the trade in goods. The current conflict has exposed how fragile supply chains can be – especially when capacities are concentrated on a few players in certain regions of the world. One possible solution to the current neon crisis – as in the case of the planned relocation of chip production back to Europe and the USA – may be the expansion of new production facilities in different locations.

The key question, however, is whether potential manufacturers are currently willing to invest in spite of the unstable economic situation. And if they do, it will probably take years before infrastructure enters service.